Helping to deliver standardized value-added API services to Corporates

Open APIs continue to play a centralized role in transforming the corporate-to-bank business and technology landscape. Corporate treasurers and other financial professionals increasingly recognize the benefits that banking APIs and other trusted third-party APIs can provide, and their ability to facilitate real time payment and cash management inquiries, including account balances.

Identifying the issues and challenges facing multi-banked corporates

Through the SWIFT Corporate-to-Bank working group, corporates, banks and other trusted third-party providers work with SWIFT to provide a cooperative and non-commercial API program where participants can openly discuss and identify industry issues impacting their daily business operations and cash management flows. Issues such as:

-

The need for global API standard language formats to facilitate communication across multiple banks from a single platform

-

Lack of API-enabled real-time payment status analytics

-

Lack of automation and high total operational costs related to treasury and cash management functions

-

The need for enhanced account balance reporting services to support the corporate treasury department

Participants can collaborate further to create standardised API solutions “purpose built” for corporates to solve those issues and identify additional use cases.

Third-Party API Use Case Payments – Account Information and Reporting

What are the industry issues?

Timely access to accurate current – available – and forward account balance information is essential for effective treasury and cash management functions. Manual, non-automated balance inquiry across multiple servicer accounts can be slow and subject to end of day or batch processing limitations, meaning there is limited visible intra-day transparency on the status of available account balances in real time. Limited transparency can result in time-consuming investigations and delays in critical daily cash and treasury management operations.

Industry Participants: Banks and Corporates

The Solution – Account Information and Reporting API

Develop the Account Information and Reporting API – to create a global standard that corporates and banks can easily adopt to streamline the account balance inquiry process by providing real time access.

Account Information and Reporting API Solution Business Benefits

-

The account balance API represents a cost-efficient and rapidly scalable standardized solution that can be applied across a large number of banks globally with minimal friction

-

Corporates can call APIs to seamlessly retrieve account balance information in real time resulting in improved cash-flow forecasting, treasury management and operational efficiencies

-

Automated access to account balance information from a single platform - reducing total operational costs

-

Flexibility for retrieving specific account details and transaction summary totals

-

Entries reported to the account (intraday account entries) for a given point in time

-

Entries booked to an account, and to provide the owner with balance information at the close of the business day at a given point in time

Account Information and Reporting API Overview

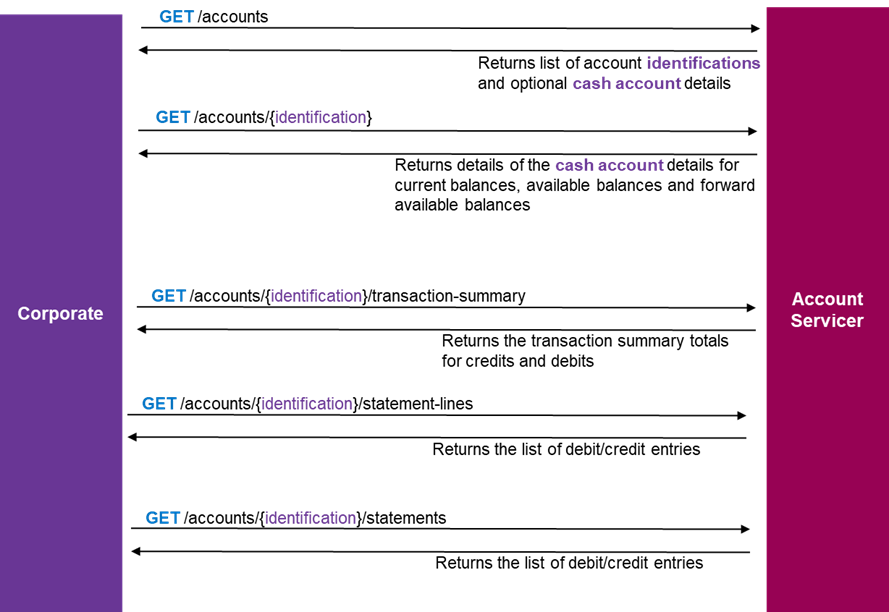

The Account Information and Reporting API provides the following features:

-

Account retrieval: account owners can retrieve a list of accounts from their account servicer

-

Individual account details: a more detailed view of an account can be accessed, including the balances:

-

Current available balance – the closing booked balance from an intraday or end of day report, or the interim booked balance; the balance calculated from booked credits and debits at the time specified and subject to further changes throughout the day

-

Available balance – the balance on the reference date

-

Forward available balance – balances including the amounts and dates that the booked amounts become available

-

-

Transaction summary: credit and debit totals for an account for a specified time period

-

Statement lines: get entries reported to an account. This will include all debit and/or credit entries booked to the account for a specified period

-

Statement: get the entries booked to an account, and the balance information on the account at a given point in time

Overview of the Account Balance API Flows